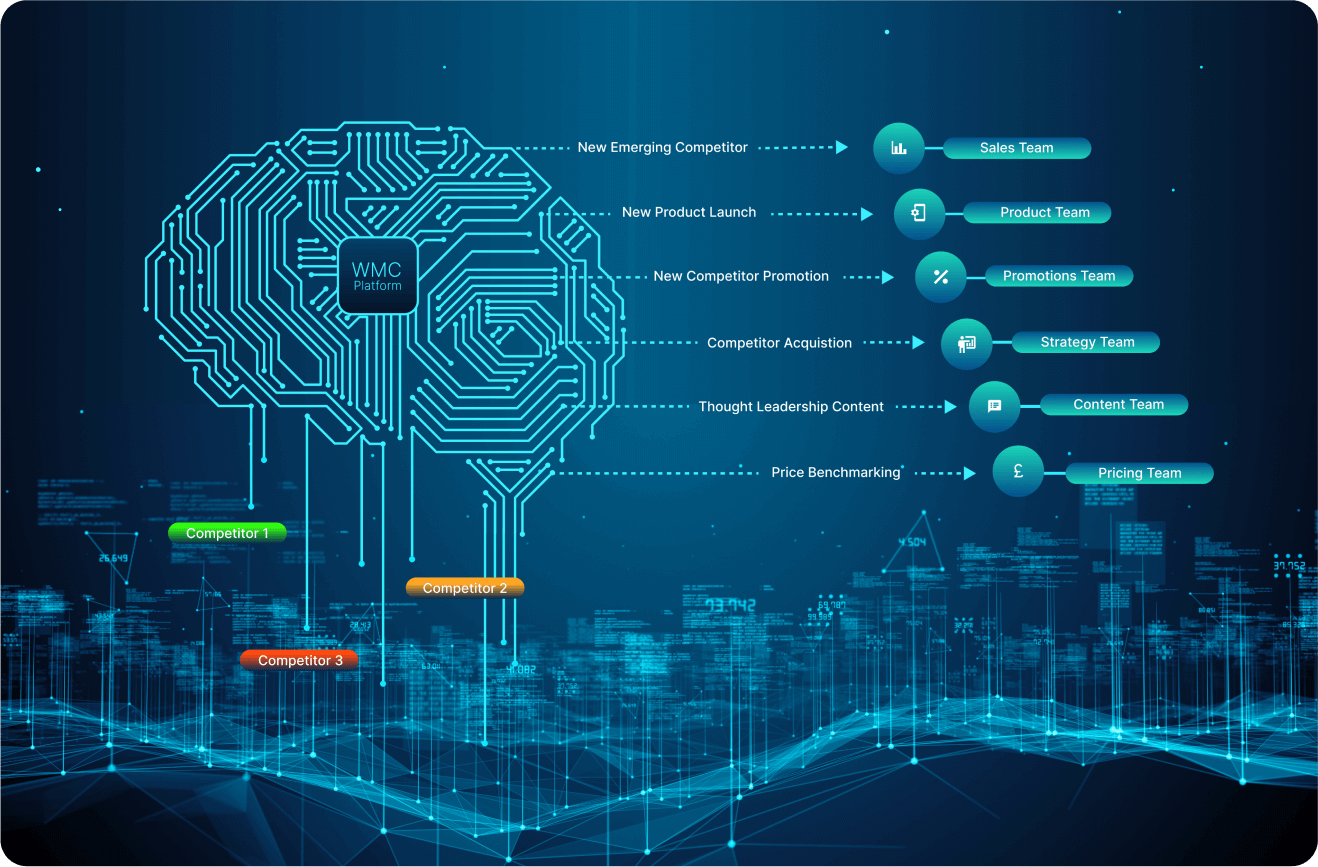

The AI competitive intelligence platform that automatically delivers actionable insights, curated by market analysts.

Protect and grow

your revenue

Automatically track your competitors. Get ahead of threats and risks. Make the most of new opportunities. WMC is your ultimate companion for building your competitive advantage.

Why WMC?

React faster to

competitor changes

Identify competitor changes as they happen. Whether it's product, pricing, promotions or another aspect of their organisation, be the first to know. Adapt your strategies to stay ahead.

Daily Alerts

Receive insights you

can actually use

Avoid feeling overwhelmed. WMC's market experts identify, analyse and curate the most relevant and actionable intelligence for you. Save time and use your insights to make positive decisions.

How It Works?

Build your intelligence

on a global scale

Track competitors from different territories. Give relevant stakeholders the intelligence to make effective decisions wherever they are.

Analytics & TrendsAI + WMC Analysts

Raw data is hard to

manage. WMC analysts

cut

through the noise to

bring you what you need

to make smart

decisions

faster.

Join more than 3,500 leaders and decision makers who are already using WMC.

We tailor our platform to your business needs.

45M

data points

tracked

70,000

man hours saved

every month

Ai-Powered CI Platform For Every Industry

Improve Customer Retention And Market Share In The Energy Utilities Sector

Learn More

Calculate the ROI

of tracking your competitors.

Ensure competitive intelligence has the impact you need.

Not sure if you can justify the cost of using a competitive intelligence platform? Use our calculator to understand the cost of giving your competitors a head start with their strategic and tactical changes.

ROI CalculatorBecome a data-driven organisation

Use WMC to give decision-makers the insights they need. Share daily alerts through existing workflows customised for each team.

Pricing

Product

Launches

Marketing

Content

Partnerships

Product

Updates

Leadership

Changes

Newsletters

Market

Expansion

Make using competitive

intelligence feel natural

WMC integrates with your existing communication and BI tools.

How effective is WMC?

WMC can transform your success.

But don’t just take our word for it.

Get smart. Get in touch.

See The Complete

Competitor Intelligence

Platform In Action

Book a demo and see exactly how

the WMC Competitor

Intelligence

platform can help you protect and

grow revenue.